February 2024 – How to Avoid the Equity Eroding Trap

The Multifamily Investment Environment

The market ended 2023 with a bit of optimism as the Fed indicated they would begin lowering rates in 2024. The 10-year traded 100bps below its September high and pundits were saying a bottom may be in.

The month of January said, “not so fast.” Multifamily investors have shown little inclination to reverse last year’s slow transaction velocity, with this month’s activity lower than the historical start to the year. That is saying a lot since last year’s transactions marked the lowest annual volume since 2014.

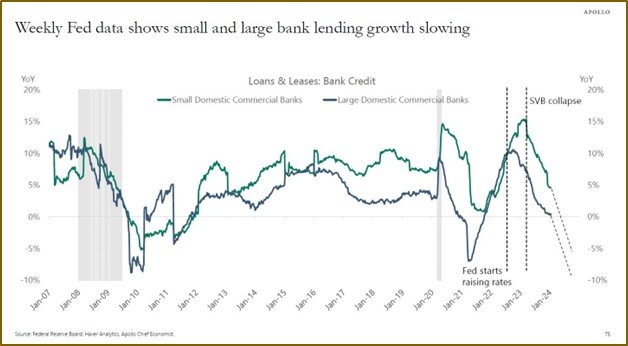

Two factors are in play as we kick off the year, (1) a continuation of tightening credit conditions despite some easing of rates, and (2) an erosion of supply/demand fundamentals.

Banks continued to rein in credit, fearful of the impact of unrealized losses on their loan portfolios and their need to bolster loss reserves.

A lot of noise has resurfaced regarding the health of the banking sector after a pause from last year’s three big bank failures. Only one of last year’s failures showed commercial real estate (CRE) as a major contributing factor but the reading over the last month has firmly planted CRE as THE contributing area of concern. This is not just a US worry but a global one with contagion fears reaching China, Japan, Germany, and the other economic powerhouses.

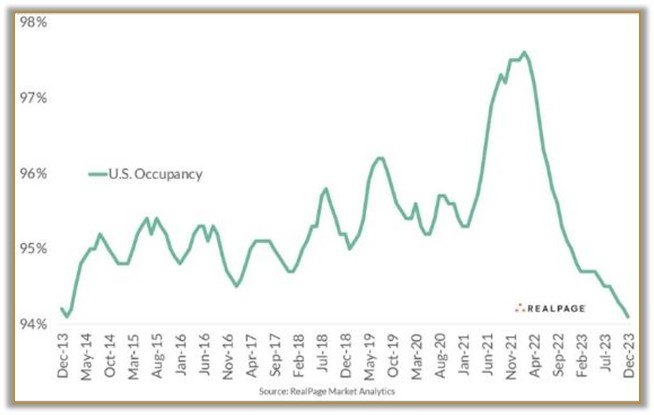

Meanwhile, the usual drivers of market cycles, supply and demand, have shown up on the radar. The impact of the highest level of new construction since 1987 is being manifested through declining occupancies.

As a result, the outsized rent growth of the pandemic era has come crashing down to earth. Especially hard hit are markets that experienced high migration during the pandemic.

Looking forward, Investors and owners will have to factor into their operating budgets and underwriting the impact another 670k + units scheduled to be delivered this year – the highest level of deliveries since 1974.

The bottom line? January ended with the wide bid-ask gap still in place. Publicly, sellers are trying to stay anchored to pandemic era pricing, but privately many have accepted a 20% - 40% valuation correction and are evaluating their best options as loan extensions begin to burn off.

Expert Insights: Cap Rate Karma – From Compression to Expansion is a B****!

It is no secret that cap rate compression made multifamily easy pickings over the last decade. Historically, cash flow (cash on cash) contributes 65% to the total returns from real estate with appreciation contributing the 35% balance. The five years leading up to 2022 saw this number reach and maintain a 20% cash flow/ 80% appreciation, return breakout. This was one of the major signs that multifamily had entered a speculative environment.

We have heard much about rent increases and operational improvements being more than capable of offsetting the cap rate expansion that began in the summer of 2022. Quite frankly, we do not understand the logic behind this rationale.

Here is a quick example of how difficult it is to overcome buying at a lower cap than the forward market is indicating. If you acquired a deal at a 4% cap – and manage it extremely aggressively over the holding period to achieve a 30% NOI increase (for simplicity), it will still suffer a - 20% equity loss if exit caps expand to 6.5%.

The bottom line? What gave so gratuitously over the last decade (steadily declining interest and cap rates) is now taking (in lost equity) just as fervently as the interest rate environment normalizes.

The reason we included the above example is that sellers have used their deal’s assumable debt at below market rates to try to justify a lower cap rate to less experienced buyers. Do not get caught in this equity eroding trap.

That is a wrap for this issue. We look forward to bringing you more insights into the challenging but rewarding world of professional multifamily investing in the next issue.

We will wrap up this issue’s Expert Insights by saying we never wish ill fortune on any industry participants, but market cycles have been around since the beginning of capitalism. Real estate is no exception, and the least experienced sponsors without a historical market perspective are usually the ones caught without a chair when the music stops.

That is a wrap for this issue. We look forward to bringing you more insights into the challenging but rewarding world of professional multifamily investing in the next issue.

Notice!

The Family Office Real Estate (FORE) Institute’s spring Investment Forum has moved to March 20-22, in Phoenix, AZ.

FORE Investment Forum 2024

This is a must attend event if you want to evaluate the best options to position your family office for upcoming destressed and opportunistic investment opportunities.

Please drop us an email if you would like to learn more about attending.