April 2024 - The Recent Capital Exodus Explained

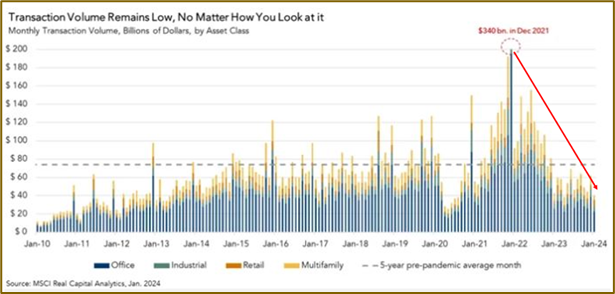

February transactions posted the weakest monthly volume since February of 2012. This represents a -35% YOY decrease and is a continuation of the trend that has seen transaction velocity fall off a cliff since 2022.

What is driving the capital exodus? In our opinion, it is a combination of weakening fundamentals, specifically new supply, alongside a structural reset. Of the two, the structural reset is the dominant cause of transactional slowdown.

We will examine the structural reset in the Expert Insights section below. For now, let us focus on a fundamental - new supply.

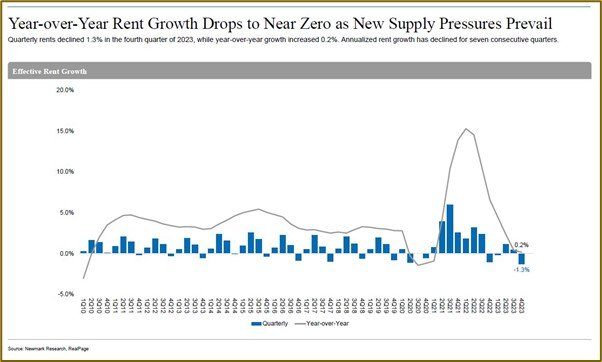

Supply continued to pile up in February with 644,000 new units delivered and 966,000 under construction. Overall, we are delivering a record high not seen since the Nixon administration in 1974.

The new supply has impacted both vacancies and rent growth. Although rent growth is flat on a national scale, many of the pandemic hot spots are now experiencing a brutal reversal.

Nowhere is the market specific impact more apparent than Atlanta. As can be seen in the following chart, rent growth has plummeted while vacancies have skyrocketed.

We are certainly aware of the prevailing development pitch making the rounds regarding the pullback in new construction and the thought that any new development starts now will be delivering into a market in 2026-2027 that will have little or no new supply.

The facts appear to call this argument into question with most of the markets in question now expecting a four-to-six-year absorption period.

We also question whether these pundits are taking into consideration that projects in process, that may temporarily stall (with major sunk costs), will restart as soon as perceived bottom is in.

Overall absorption is lagging supply, and the macro market appears to be over supplied in the short-term warranting caution. The complete story waits to be written but at the very least, a solid supply/demand market analysis should be incorporated into any deployment consideration.

Expert Insights: Deciphering Structural vs Cyclical Changes

We believe real estate investment is in the midst of a structural deleveraging. What do we mean by “structural”? Structural refers to more permanent changes, whereas cyclical refers to temporary changes such as the short-term oversupply discussed above.

Why do we believe we are undergoing a structural deleveraging? Real estate at less than a 6% cap rate is simply not competitive in the current rate environment. Well over 90% of multifamily investment incorporates debt in the capital stack and investors cannot hit true risk-adjusted return targets using realistic underwriting assumptions at cap rates less than 6% (on stabilized properties).

In recent issues, we have suggested that the current interest rate environment is more of a reversion to mean than an abnormality. Barring a systemic event, our outlook for the risk-free benchmark 10-year Treasury encapsulates a range of 3.25% - 4.25% over the next five years. When you add the historical risk premium (3%-4%) to the risk-free benchmark rate we arrive at cap rates in the 6.25% - 8.25% range. Again, this cap rate range is required to make the numbers work for deploying capital – the major reason buyers will eventually win the bid/ask gap war.

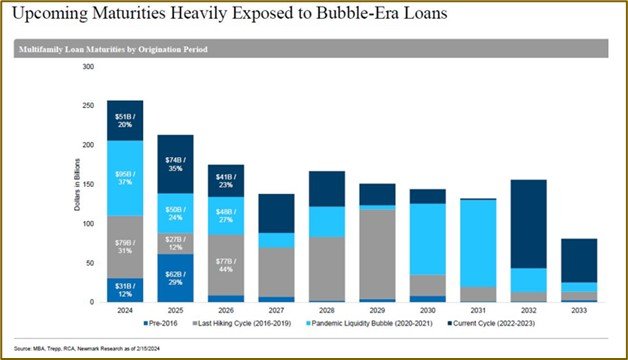

Obviously, this range spells disaster for the majority of the multifamily assets acquired during the topping period of 2020-2022 (Bubble-Era). These assets are experiencing insolvency issues – with valuations falling below their outstanding mortgage balance. Adding another trigger to upcoming distress is the erosion of operating fundamentals such as short-term oversupply that hits occupancy and income. Not an enviable situation to be in but one that manifests at the end of each cycle.

Insolvency issues can be avoided if the asset can hold and wait until values recover as long as it is not experiencing liquidity issues. Liquidity issues means the clock is ticking and something must be done before time runs out. A combination of both is a dual trigger for a forced sale or foreclosure.

The final nail in the coffin for many of the Bubble-Era deals will be their loan maturity. A significant portion of these loans had short maturities that were financing value-add projects. They are now coming due in a very different environment than when they were originally issued.

It is estimated that up to 50% of the upcoming maturities over the next two years will struggle to refinance (from liquidity issues), before even taking valuation concerns into account. This is why we believe the upcoming wave of maturities will overwhelm lender’s ability to extend and pretend.

We will wrap up this issue’s Expert Insights by saying there is no substitute for experience when it comes to understanding market cycles, their causes and potential outcomes. We hope you have found this issue enlightening and invite you to contact us with any questions or thoughts. We are always happy to help.

Shaping a Brighter Future for Generations to Come

As part of the board of The Family Office Real Estate Institute, we work alongside families, family offices, and renowned professors from the top real estate programs in the country to help direct the institute's programming, education, and direction.